how much does colorado tax paychecks

FICA taxes consist of Social Security and Medicare taxes. Colorado charges new employers standard unemployment tax rates based upon the type of business.

Colorado Paycheck Calculator Adp

If you make more than a certain.

. In amounts up to. These amounts are paid by both employees and employers. How to File Online.

Filing Frequency Due Dates. This Colorado bonus tax calculator uses supplemental tax rates to calculate withholding on special wage payments such as bonuses. The Colorado salary calculator will show you how much income tax you will pay each.

The Centennial State has a flat income tax rate of 450 and one of the lowest statewide sales taxes in the country at just 290. All residents pay the same flat income tax rate. How is personal income tax withheld from paychecks in Colorado.

However because of numerous additional. The current rate is lower than the 475 percent rate set in 1999 and. The state income tax in Colorado is assessed at a flat rate of 463 which means that everyone in Colorado pays that same rate regardless of their income level.

Colorado has a flat tax rate of 455 for 2022. Calculating your Colorado state income tax is similar to the steps we listed on our Federal paycheck calculator. For 2022 rates range from 020 to 758.

However because of numerous additional. How to Remit Income Tax Withholding. Individual Colorado taxpayers can expect early refund checks of 750 in late summer while joint filers could see 1500 checks according to estimates from an economic forecast released.

For 2022 employees will pay 62 in Social Security on the. Thats because you have two taxes to worry about. Colorado State Tax Your employees estimated take home pay.

How to Submit Withholding Statements. Colorado state income tax cut. The Colorado bonus tax percent calculator will tell.

63 flat rateSales tax. 145 of each of your paychecks is withheld for Medicare taxes and your employer contributes another 145. It must get 50 percent of the vote to pass.

The Colorado income tax has one tax bracket with a maximum marginal income tax of 463 as of 2022. Yes Colorados personal income tax is a flat tax system. How to Report Year.

0 cents per gallon. 49 average effective rateGas tax. First up is Social Security Tax which is 62 of each employees taxable wages until they reach an annual earning of.

There is no income limit on Medicare taxes. Denver is the capital and most populous city of the Centennial State. Coloradans were supporting this tax cut by a margin of 6525 percent to 3475 percent.

Does Colorado have a personal income tax. Does Colorado have personal income tax. Colorado has a population of over 5 million 2019 and is one of the Mountain States.

The income tax is a flat rate of 495. Detailed Colorado state income tax rates and brackets are available on this page. There is also between a 025 and 075 when it comes to county tax.

Taxes in ColoradoColorado State Tax Quick FactsIncome tax. If the wage withholding tax due for a filing period is greater than the amount previously reported and paid the additional tax can be reported and paid via EFT online at.

How To Reduce Your Taxable Income And Pay No Taxes Personal Capital

Free Online Paycheck Calculator Calculate Take Home Pay 2022

Esmart Paycheck Calculator Free Payroll Tax Calculator 2022

Colorado Paycheck Calculator Smartasset

Colorado State Taxes 2021 2022 Income And Sales Tax Rates Bankrate

State Income Taxes Highest Lowest Where They Aren T Collected

Irs Announces Tax Inflation Adjustments Why Your Paycheck Could See A Bump Westernslopenow Com

Paycheck Calculator Salary Or Hourly Plus Annual Summary Of Tax Holdings Deductions No Ads Amazon Com Appstore For Android

5 Tricks For Getting A Bigger Paycheck In 2021 Money

Lafayette Wl Lock In New Income Tax For Police Fire Hits Paychecks In 2020

Arizona Paycheck Calculator Smartasset

2022 State Income Tax Rankings Tax Foundation

Colorado Payroll Tools Tax Rates And Resources Paycheckcity

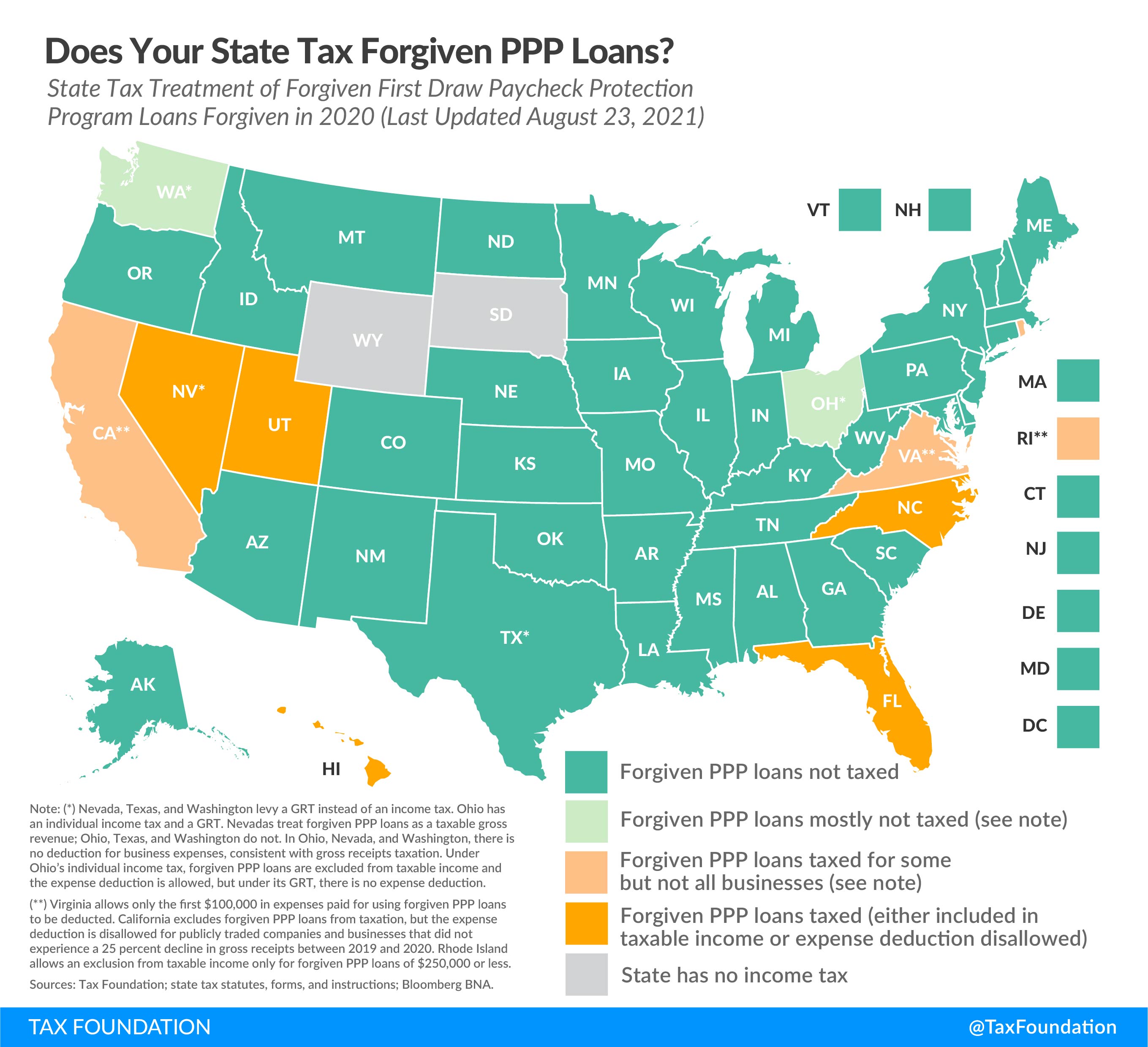

Ppp Loan Forgiveness Which States Are Taxing Forgiven Ppp Loans

New York Hourly Paycheck Calculator Gusto

Colorado Income Tax Calculator Smartasset

Why Are My Taxes So High On My Paycheck Hall Accounting Co

What Does Withholding Tax Mean Check City

![]()

Free Hourly Payroll Calculator Hourly Paycheck Payroll Calculator